1099’s are Here!

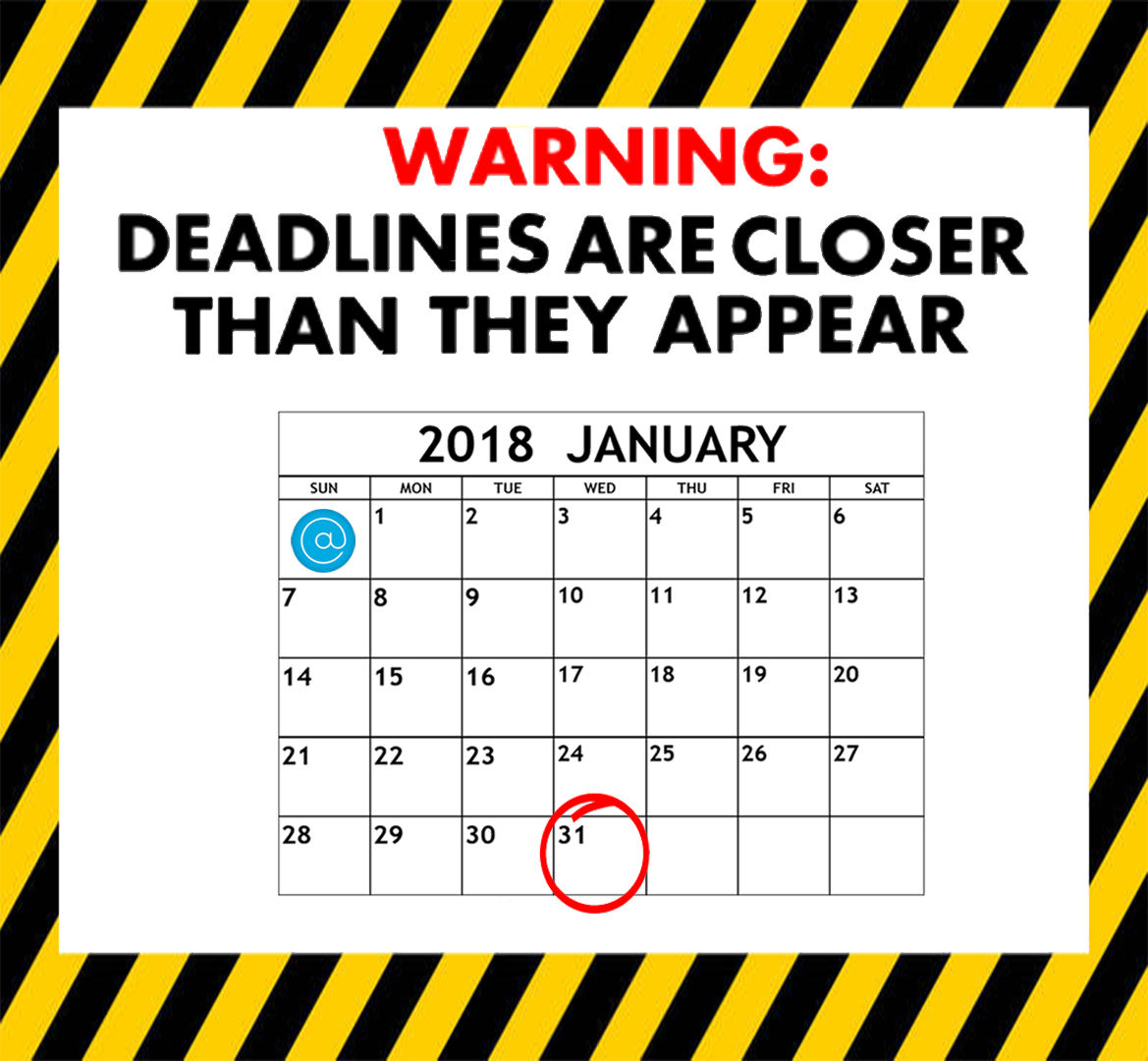

Payroll tax filing dates for 1099 forms were changed for 2016 taxes, and these changes continue for reporting 2017 taxes. The filing deadline for 2017 1099 forms (including Form 1099-MISC) and 1096 transmittal forms is January 31, 2018, whether you use paper forms or file electronically.

You need to make sure as a business owner that you have:

- Made sure that All Independent Contractors have completed a correct and updated W-9 form.

- Verified accuracy of contractor’s information.

- Reviewed year-end totals for any discrepancies.

At Your Service Group is committed to helping you with your 1099 filings and trying to furnish you with useful information regarding these filings. Here are some helpful IRS links regarding filing 1099s: